'Asset Turnover Ratio'

Asset turnover ratio is the ratio between the value of a company’s sales or revenues and the value of its assets. It is an indicator of the efficiency with which a company is deploying its assets to produce the revenue. Thus, asset turnover ratio can be a determinant of a company’s performance. The higher the ratio, the better is the company’s performance. Asset turnover ratio can be different from company to company. Usually, it is calculated on an annual basis for a specific financial year.

'Bank Rate'

Definition: Bank rate is the rate charged by the central bank for lending funds to commercial banks.

Description: Bank rates influence lending rates of commercial banks. Higher bank rate will translate to higher lending rates by the banks. In order to curb liquidity, the central bank can resort to raising the bank rate and vice versa.

'Broad Money To Reserve Money'

Definition: It is a measure of money multiplier. Money multiplier shows the mechanism by which reserve money creates money supply in the economy. It is again dependent on two variables, namely currency deposit ratio and reserve deposit ratio.

Description: M3 is a measure of broad money and includes currency with the public and deposits. The Reserve Money factor shows the reserve money and includes required reserve and the excess reserves of the banking system. If the reserve requirement as stipulated by the RBI increases, the Reserve Money value will increase and the multiplier will fall. Similarly, if banks keep more money as excess reserves, it will have an adverse effect on the money multiplier.

'Casa'

Definition: CASA stands for Current Account and Savings Account which is mostly used in West Asia and South-east Asia. CASA deposit is the amount of money that gets deposited in the current and savings accounts of bank customers. It is the cheapest and major source of funds for banks. The savings accounts portion pays more interest compared to current accounts.

'Clearing Price'

Definition: Clearing price is that price of a commodity or a security at which the market clears a commodity or a security. Quantity supplied is equal to quantity demanded and buyers and sellers conduct the trade.

Description: A price is a specific monetary value associated with a security or a commodity. Generally, it so happens that sellers expect to get the highest possible price for their product, while buyers want to get it at the lowest possible price.

In such a scenario, a price that settles the transaction so that both the parties are in agreement is called the clearing price. Where this price settles is influenced by various other factors. It can also be referred to as the equilibrium price.

'Contagion'

Definition: In economics and finance, a contagion can be explained as a situation where a shock in a particular economy or region spreads out and affects others by way of, say, price movements.

Description: The contagion effect explains the possibility of spread of economic crisis or boom across countries or regions. This phenomenon may occur both at a domestic level as well as at an international level. The failure of Lehman Brothers in the United States is an example of a domestic contagion.

The fundamental underlying this scenario where price movements in one market are resultant of shocks or volatility in the other market is that there is a perfect information flow. With increasing interdependence and correlation between economies, this possibility has increased. While internationally, there could a number of other factors governing trade, which may influence the extent of this contagion effect across geographies.

'Dividend Signalling'

Definition: This is a theory which asserts that announcement of increased dividend payments by a company gives strong signals about the bright future prospects of the company.

Description: An announcement of an increase in dividend pay out is taken very positively in the market and helps building a very positive image of the company regarding the growth prospects and stability in the future.

Generally, dividend signaling is done by the company when it changes the amount of dividend to be paid to shareholders.

'Ease Of Doing Business'

Definition: Ease of doing business is an index published by the World Bank. It is an aggregate figure that includes different parameters which define the ease of doing business in a country.

'Infrastructure Investment Trusts'

Definition: An Infrastructure Investment Trust (InvITs) is like a mutual fund, which enables direct investment of small amounts of money from possible individual/institutional investors in infrastructure to earn a small portion of the income as return. InvITs work like mutual funds or real estate investment trusts (REITs) in features. InvITs can be treated as the modified version of REITs designed to suit the specific circumstances of the infrastructure sector.

'Libor'

Definition: LIBOR, the acronym for London Interbank Offer Rate, is the global reference rate for unsecured short-term borrowing in the interbank market. It acts as a benchmark for short-term interest rates. It is used for pricing of interest rate swaps, currency rate swaps as well as mortgages. It is an indicator of the health of the financial system and provides an idea of the trajectory of impending policy rates of central banks

'Liquidity Trap'

Definition: Liquidity trap is a situation when expansionary monetary policy (increase in money supply) does not increase the interest rate, income and hence does not stimulate economic growth.

Description: Liquidity trap is the extreme effect of monetary policy. It is a situation in which the general public is prepared to hold on to whatever amount of money is supplied, at a given rate of interest. They do so because of the fear of adverse events like deflation, war.

'Non Performing Assets'

Definition: A non performing asset (NPA) is a loan or advance for which the principal or interest payment remained overdue for a period of 90 days.

Description: Banks are required to classify NPAs further into Substandard, Doubtful and Loss assets.

- Substandard assets: Assets which has remained NPA for a period less than or equal to 12 months.

- Doubtful assets: An asset would be classified as doubtful if it has remained in the substandard category for a period of 12 months.

- Loss assets: As per RBI, “Loss asset is considered uncollectible and of such little value that its continuance as a bankable asset is not warranted, although there may be some salvage or recovery value.”

Pareto's efficiency

Pareto’s efficiency is defined as the economic situation when the circumstances of one individual cannot be made better without making the situation worse for another individual. Pareto’s efficiency takes place when the resources are most optimally used. Pareto’s efficiency was theorized by the Italian economist and engineer Vilfredo Pareto.

Description: It is a purely economic concept and has no relationship with the concept of equal or fair utilization of resources. It has wide applications in the field of economics and engineering.

It is the final optimum solution beyond which any change would directly lead to loss in the allocation of resources. Pareto’s efficiency is, thus, the complete solution in itself. However, it is almost impossible to achieve.

'Social Capital'

Definition: In financial terms, social capital basically comprises the value of social relationships and networks that complement the economic capital for economic growth of an organization.

'Stimulus Package'

Definition: Stimulus package is a package of tax rebates and incentives used by the governments of various countries to stimulate economy and save their country from a financial crisis.

Description: The idea behind a stimulus package is to provide tax rebates and boost spending, as spending increases demand, which leads to an increase in employment rate which in turn increases income and hence boosts spending. This cycle continues until the economy recovers from collapse. One such stimulus package was used by the United States in 2008 during the time of the global recession, which was aimed at increasing employment and recovery of the US economy.

India too used its first stimulus package in 2008 to ensure the safety of bank deposits and stability of the financial system. The government took necessary steps to infuse liquidity into the banking system. In an effort to infuse liquidity into the banking system, RBI reduced the CRR as well as repo and reverse repo rates. Also, the problems faced by non-banking financing companies were addressed.

'Unemployment Trap'

Definition: Unemployment trap is a situation when unemployment benefits discourage the unemployed to go to work. People find the opportunity cost of going to work too high when one can simply enjoy the benefits by doing nothing.

Description: While the purpose of social security and welfare systems is to provide relief to the unemployed, they end up providing them with an incentive not to return to work. An unemployment trap arises when opportunity cost of going to work is higher than the income received, discouraging people from returning to work and being productive.

'Venture Capital'

Definition: Start up companies with a potential to grow need a certain amount of investment. Wealthy investors like to invest their capital in such businesses with a long-term growth perspective. This capital is known as venture capital and the investors are called venture capitalists.

'Bailout'

Definition: Bailout is a general term for extending financial support to a company or a country facing a potential bankruptcy threat. It can take the form of loans, cash, bonds, or stock purchases. A bailout may or may not require reimbursement and is often accompanied by greater government oversee and regulations.

'Balance Of Payment'

Definition: According to the RBI, balance of payment is a statistical statement that shows

- The transaction in goods, services and income between an economy and the rest of the world,

- Changes of ownership and other changes in that economy’s monetary gold, special drawing rights (SDRs), and financial claims on and liabilities to the rest of the world, and

- Unrequited transfers.

'Brexit'

Definition: It is an abbreviation for the term “British exit”, similar to “Grexit” that was used for many years to refer to the possibility of Greece leaving the Eurozone. Brexit refers to the possibility of Britain withdrawing from the European Union (EU).

'Base Rate' (already asked in UPSC prelims)

Definition: Base rate is the minimum rate set by the Reserve Bank of India below which banks are not allowed to lend to its customers.

Description: Base rate is decided in order to enhance transparency in the credit market and ensure that banks pass on the lower cost of fund to their customers. Loan pricing will be done by adding base rate and a suitable spread depending on the credit risk premium.

'Catch Up Effect'

Definition: Catch up effect, alternatively called the theory of convergence, states that poor or developing economies grow faster compared to economies with a higher per capita income and gradually reach similar high levels of per capita income. Thus, all economies, over time, may converge in terms of income per head.

'Ceteris Paribus'

Definition: This commonly-used phrase stands for ‘all other things being unchanged or constant’. It is used in economics to rule out the possibility of ‘other’ factors changing, i.e. the specific causal relation between two variables is focused.

'Contractionary Policy'

Definition: A contractionary policy is a kind of policy which lays emphasis on reduction in the level of money supply for a lesser spending and investment thereafter so as to slow down an economy.

Description: A nation’s central bank uses monetary policy tools such as CRR, SLR, repo, reverse repo, interest rates etc to control the money supply flows into the economy. Such measures are used at high growth periods of the business cycle or in times of higher than anticipated inflation. Discouraging spending by way of increased interest rates and reduced money supply helps control rising inflation. It may also lead to increased unemployment at the same time.

Countervailing Duties

Definition: Duties that are imposed in order to counter the negative impact of import subsidies to protect domestic producers are called countervailing duties.

'Cross Elasticity Of Demand'

Definition: A situation when increased interest rates lead to a reduction in private investment spending such that it dampens the initial increase of total investment spending is called crowding out effect.

Description: Sometimes, government adopts an expansionary fiscal policy stance and increases its spending to boost the economic activity. This leads to an increase in interest rates. Increased interest rates affect private investment decisions. A high magnitude of the crowding out effect may even lead to lesser income in the economy.

'Deadweight Loss'

Definition: It is the loss of economic efficiency in terms of utility for consumers/producers such that the optimal or allocative efficiency is not achieved.

Description: Deadweight loss can be stated as the loss of total welfare or the social surplus due to reasons like taxes or subsidies, price ceilings or floors, externalities and monopoly pricing. It is the excess burden created due to loss of benefit to the participants in trade which are individuals as consumers, producers or the government.

'Debt Equity Ratio'

Definition: The debt-equity ratio is a measure of the relative contribution of the creditors and shareholders or owners in the capital employed in business. Simply stated, ratio of the total long term debt and equity capital in the business is called the debt-equity ratio.

It can be calculated using a simple formula:

Debt Equity Ratio = Total Liabilities / Equity.

'Due Date Rate'

Definition: Due date, also known as maturity date, is the day when some accruals fall due. Due date rate is the amount of debt that has to be paid on a date decided in the past. It can also be known as maturity date rate. If the due date amount is higher than the actual amount, then it results in profit, otherwise it’s a loss.

'Etf' or exchange traded funds'

Definition: ETFs or exchange traded funds are similar to index mutual funds. However, they trade just like stocks.

Description: ETFs were started in 2001 in India. They comprise a portfolio of equity, bonds and trade close to its net asset value. These funds mainly track an index, a commodity, or a pool of assets.

They have the following advantages over mutual funds and equity/debt funds:

- Lower Costs: An investor who buys an ETF doesn’t have to pay an advisory/management fee to the fund manager and taxes are relatively lower in ETFs.

- Lower Holding Costs: As commodity ETFs are widely traded in, there isn’t any physical delivery of commodity. The investor is just provided with an ETF certificate, similar to a stock certificate.

'Fallout Risk'

Definition: Fallout risk or borrower fallout is one of the two components of pipeline risk, the other being price risk. The risk can simply be defined as the probability of a prospective borrower failing to complete his/her mortgage loan transaction. Usually, a high fallout risk occurs when the finalisation of a mortgage deal is contingent upon another deal, such as the sale of a real estate asset.

It is because if the deal fails to go through, it is said to have fallen out of the lender’s pipeline. Here, pipeline refers to the loan commitment made by the mortgage originator or lender and also the loan application processed. The risk arises when the mortgage originators give potential borrowers the right, but not the obligation, to cancel the agreement.

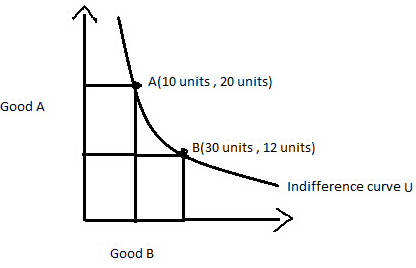

'Indifference Curve'

Definition: An indifference curve is a graph showing combination of two goods that give the consumer equal satisfaction and utility. Each point on an indifference curve indicates that a consumer is indifferent between the two and all points give him the same utility.

Description: Graphically, the indifference curve is drawn as a downward sloping convex to the origin. The graph shows a combination of two goods that the consumer consumes.

'Marginal Standing Facility'

Definition: Marginal standing facility (MSF) is a window for banks to borrow from the Reserve Bank of India in an emergency situation when inter-bank liquidity dries up completely.

Description: Banks borrow from the central bank by pledging government securities at a rate higher than the repo rate under liquidity adjustment facility or LAF in short. The MSF rate is pegged 100 basis points or a percentage point above the repo rate. Under MSF, banks can borrow funds up to one percentage of their net demand and time liabilities (NDTL).

'Mibor'

Definition: MIBOR is the acronym for Mumbai Interbank Offer Rate, the yardstick of the Indian call money market. It is the rate at which banks borrow unsecured funds from one another in the interbank market. At present, it is used as a reference rate for floating rate notes, corporate debentures, term deposits, interest rate swaps and forward rate agreements. The pricing of overnight indexed swaps, a type of overnight interest rate swap used for hedging interest rate risk is based on overnight MIBOR.

'Moral Hazard'

Definition: Moral hazard is a situation in which one party gets involved in a risky event knowing that it is protected against the risk and the other party will incur the cost. It arises when both the parties have incomplete information about each other.

'Payments Banks'

Definition: A payments bank is like any other bank, but operating on a smaller scale without involving any credit risk. In simple words, it can carry out most banking operations but can’t advance loans or issue credit cards. It can accept demand deposits (up to Rs 1 lakh), offer remittance services, mobile payments/transfers/purchases and other banking services like ATM/debit cards, net banking and third party fund transfers.

Description: In September 2013, the Reserve Bank of India constituted a committee headed by Dr Nachiket Mor to study ‘Comprehensive financial services for small businesses and low income households’. The objective of the committee was to propose measures for achieving financial inclusion and increased access to financial services.

The committee submitted its report to RBI in January 2014. One of the key suggestions of the committee was to introduce specialised banks or ‘payments bank’ to cater to the lower income groups and small businesses so that by January 1, 2016 each Indian resident can have a global bank account.

Why payments banks? The main objective of payments bank is to widen the spread of payment and financial services to small business, low-income households, migrant labour workforce in secured technology-driven environment.

With payments banks, RBI seeks to increase the penetration level of financial services to the remote areas of the country.

Existing prepaid payment instruments (PPI model) like Airtel Money does not give pay any interest on deposits.

'Nim'

Definition: Net interest margin or NIM denotes the difference between the interest income earned and the interest paid by a bank or financial institution relative to its interest-earning assets like cash. Thanks to its frequent usage, it’s become a part of the banking and financial lexicon.

Description: Net interest margin = (Investment returns – interest expenses) / average earning on assets.

'Phillips Curve'

Definition: The inverse relationship between unemployment rate and inflation when graphically charted is called the Phillips curve. William Phillips pioneered the concept first in his paper “The Relation between Unemployment and the Rate of Change of Money Wage Rates in the United Kingdom, 1861-1957,’ in 1958. This theory is now proven for all major economies of the world.

Description: The theory states that the higher the rate of inflation, the lower the unemployment and vice-versa. Thus, high levels of employment can be achieved only at high levels of inflation. The policies to induce growth in an economy, increase in employment and sustained development are heavily dependent on the findings of the Phillips curve.

However, the implications of Phillips curve have been found to be true only in the short term. Phillips curve fails to justify the situations of stagflation, when both inflation and unemployment are alarmingly high.

'Poverty Trap'

Definition: Poverty trap is a spiraling mechanism which forces people to remain poor. It is so binding in itself that it doesn’t allow the poor people to escape it. Poverty trap generally happens in developing and under-developing countries, and is caused by a lack of capital and credit to people.

'Purchasing Power Parity'

Definition: The theory aims to determine the adjustments needed to be made in the exchange rates of two currencies to make them at par with the purchasing power of each other. In other words, the expenditure on a similar commodity must be same in both currencies when accounted for exchange rate. The purchasing power of each currency is determined in the process.

'Quantitative Easing'

Definition: Quantitative easing is an occasionally used monetary policy, which is adopted by the government to increase money supply in the economy in order to further increase lending by commercial banks and spending by consumers. The central bank (Read: The Reserve Bank of India) infuses a pre-determined quantity of money into the economy by buying financial assets from commercial banks and private entities. This leads to an increase in banks’ reserves.

'Seasonal Adjustment'

Definition: This is a technique aimed at analyzing economic data with the purpose of removing fluctuations that take place as a result of seasonal factors.

'Seigniorage'

Definition: Seigniorage is the difference between the value of currency/money and the cost of producing it. It is essentially the profit earned by the government by printing currency.

Description: It can also be termed as a source of revenue for governments as the value of money printed is generally higher than the cost of producing it.

'Special Drawing Rights'

Definition: This is a kind of reserve of foreign exchange assets comprising leading currencies globally and created by the International Monetary Fund in the year 1969.

Description: Before its creation, the international community had to face several restrictions in increasing world trade and the level of financial development as gold and US dollars, which were the only means of trade, were in limited quantities. In order to address the issue, SDR was created by the IMF.

'Statutory Liquidity Ratio'

Definition: The ratio of liquid assets to net demand and time liabilities (NDTL) is called statutory liquidity ratio (SLR).

Description: Apart from Cash Reserve Ratio (CRR), banks have to maintain a stipulated proportion of their net demand and time liabilities in the form of liquid assets like cash, gold and unencumbered securities. Treasury bills, dated securities issued under market borrowing programme and market stabilisation schemes (MSS), etc also form part of the SLR. Banks have to report to the RBI every alternate Friday their SLR maintenance, and pay penalties for failing to maintain SLR as mandated.

'Windfall Gains'

Definition: Windfall gain (or windfall profit) is an unexpected gain in income which could be due to winning a lottery, unforeseen inheritance or shortage of supply. Windfall gains are transitory in nature.

Description: For instance, when real estate property prices rise dramatically, the owner can make a substantial amount of profit by selling property. This sudden and unexpected rise in income is called windfall profit. Many countries define proper laws to tax windfall profits.

'Velocity Of Circulation'

Definition: Velocity of circulation is the amount of units of money circulated in the economy during a given period of time.

Description: Velocity of circulation is measured by dividing GDP by the country’s total money supply. A high velocity of circulation in a country indicates a high degree of inflation. It helps in determining how vigorous a country’s economy is.

Foreign Direct Investment (FDI):

It is a controlling ownership in a business enterprise in one country by an entity, based in another country.

Foreign Institutional Investors (FII):

FIIs are those institutional investors which invest in the assets belonging to a different country other than that where these organizations are based.

General Anti-Avoidance Rules (GAAR):

A GAAR is a statutory rule that empowers a revenue authority to deny taxpayers the benefit of an arrangement that they have entered into for an impermissible tax-related purpose.

Money Laundering:

Any act to hide the identity of illegally obtained proceeds so that they appear to have originated from genuine sources.

Participatory notes or P-Notes:

These are instruments, issued by registered foreign institutional investors (FII) to overseas investors, who wish to invest in the Indian stock markets without registering themselves with the market regulator, the Securities and Exchange Board of India (SEBI).

Quantitative easing and tapering:

A monetary policy in which RBI purchases government securities or other securities from the market in order to lower interest rates and increase the money supply.

CAMELs rating system:

An international bank-rating system where bank supervisory authorities rate institutions according to six factors. The six factors are represented by the acronym “CAMELS”.

C – Capital adequacy

A – Asset quality

M – Management quality

E – Earnings

L – Liquidity

S – Sensitivity to Market Risk

CORE Banking Solution (CBS):

It is networking of branches, which enables Customers to operate their accounts, and avail banking services from any branch of the Bank on CBS network, regardless of where he maintains his account.

Initial Public Offering (IPO):

It is a type of public offering in which shares of a company usually are sold to institutional investors that in turn, sell to the general public, on a securities exchange, for the first time.

Open Market Operations (OMO):

It’s an activity by a RBI to give or take liquidity in its currency to or from a bank or a group of banks.

Bancassurance:

The selling of life assurance and other insurance products and services by banking institutions.