1.National Green Tribunal

It is a specialised body set up under the National Green Tribunal Act (2010) for effective and expeditious disposal of cases relating to environmental protection and conservation of forests and other natural resources.

Structure

- The Tribunal comprises of the Chairperson, the Judicial Members and Expert Members. They shall hold office for term of five years and are not eligible for reappointment.

- The Chairperson is appointed by the Central Government in consultation with Chief Justice of India (CJI).

- A Selection Committee shall be formed by central government to appoint the Judicial Members and Expert Members.

- There are to be least 10 and maximum 20 full time Judicial members and Expert Members in the tribunal.

Powers & Jurisdiction

- Tribunal has jurisdiction over all civil cases involving substantial question relating to environment.

- NGT also has appellate jurisdiction to hear appeal as a Court.

- Shall be guided by principles of ‘natural justice’.It shall apply the principles of sustainable development, the precautionary principle and the polluter pays principle.

- An order/decision/award of Tribunal is executable as a decree of a civil court.

- An appeal against order/decision/ award of the NGT lies to the Supreme Court, generally within ninety days from the date of communication.

The NGT deals with civil cases under the seven laws related to the environment, these include:

- The Water (Prevention and Control of Pollution) Act, 1974,

- The Water (Prevention and Control of Pollution) Cess Act, 1977,

- The Forest (Conservation) Act, 1980,

- The Air (Prevention and Control of Pollution) Act, 1981,

- The Environment (Protection) Act, 1986,

- The Public Liability Insurance Act, 1991 and

- The Biological Diversity Act, 2002.

2. Central Pollution Control Board- CPCB

- CPCB is a statutory organisation which was constituted in September, 1974 under the Water (Prevention and Control of Pollution) Act, 1974.

- It was entrusted with the powers and functions under the Air (Prevention and Control of Pollution) Act, 1981.

- It serves as a field formation and also provides technical services to the Ministry of Environment and Forests of the provisions of the Environment (Protection) Act, 1986.

- Principal Functions of the CPCB, as spelt out in the Water (Prevention and Control of Pollution) Act, 1974, and the Air (Prevention and Control of Pollution) Act, 1981

- to promote cleanliness of streams and wells in different areas of the States by prevention, control and abatement of water pollution.

- to improve the quality of air and to prevent, control or abate air pollution in the country.

3. Biomedical Waste Disposal

As informed by CPCB and as per Bio-medical Waste Management Rules, 2016, Bio-medical waste is required to be segregated in 4 color coded waste categories.

- Common methods of treatment and disposal of bio-medical waste are by incineration/plasma pyrolysis/deep-burial for Yellow Category waste;

- Autoclaving/microwaving/chemical disinfection for Red Category waste;

- Sterilization and shredding, disinfection followed by burial in concrete pit/recycling through foundry/encapsulation for White Category sharps waste; and

- Washing, disinfection followed by recycling for Blue Category glass waste.

4. E-Waste

- E-Waste is short for Electronic-Waste. It is the term used to describe old, end-of-life or discarded electronic appliances. It includes computers, mobiles, consumer electronics etc.

- E-waste consists of toxic elements such as Lead, Mercury, Cadmium, Chromium, Polybrominated biphenyls and Polybrominated diphenyl.

- Non-Disposal and burning of e-waste can have serious implications on human health and can cause air, soil pollution and groundwater contamination.

- According to the Global E-Waste Monitor 2017, India generates about 2 million tonnes (MT) of E-waste annually.

- India ranks fifth among E-waste producing countries, after the US, China, Japan and Germany.

- The government has implemented the E-waste (Management) Rules (2016) which enforces the Extended Producer Responsibility (EPR).

- Under EPR principle the producers have been made responsible to collect a certain percentage of E-waste generated from their goods once they have reached their “end-of-life”.

- India’s first e-waste clinic to be set-up in Bhopal, Madhya Pradesh.

5. CITES

- The Convention on International Trade in Endangered Species of Wild Fauna and Flora, often referred to as CITES , is an agreement between governments that regulates the international trade of wildlife and wildlife products—everything from live animals and plants to food, leather goods, and trinkets.

- It came into force in 1975.

- CITES was first conceived of at a 1963 meeting of the International Union for the Conservation of Nature (IUCN), the global authority on the conservation status of wild animals and plants.

There are three appendices: Appendix I, II, and III. Each denotes a different level of protection from trade.

- Appendix I includes species that are in danger of extinction because of international trade. Permits are required for import and export, and trade for commercial purposes is prohibited. Trade may be allowed for research or law enforcement purposes, among a few other limited reasons, but first the source country must confirm that taking that plant or animal won’t hurt the species’ chance of survival. (This is known as a “non-detriment finding.”)

- Appendix II includes species that aren’t facing imminent extinction but need monitoring to ensure that trade doesn’t become a threat. Export is allowed if the plant, animal, or related product was obtained legally and if harvesting it won’t hurt the species’ chance of survival.

- Appendix III includes species that are protected in at least one country, when that country asks others for help in regulating the trade.

6. Convention on Migratory Species (CMS)

The CMS is an environmental treaty of the UN that provides a global platform for the conservation and sustainable use of migratory animals and their habitats. It is the only global convention specialising in the conservation of migratory species, their habitats and migration routes.

The pact was signed in 1979 in Germany and is known as the Bonn Convention.

- Appendix I of the Convention lists ‘Threatened Migratory Species’.

- Appendix II lists ‘Migratory Species requiring international cooperation’.

India and the CMS

- India has been a party to the CMS since 1983. According to the Ministry of Environment, Forest and Climate Change, “India is a temporary home to several migratory animals and birds. The important among these include Amur Falcons, Bar-headed Geese, Black-necked cranes, Marine turtles, Dugongs, Humpbacked Whales, etc. The Indian sub-continent is also part of the major bird flyway network, i.e, the Central Asian Flyway (CAF) that covers areas between the Arctic and Indian Oceans, and covers at least 279 populations of 182 migratory water-bird species, including 29 globally threatened species. India has also launched the National Action Plan for the conservation of migratory species under the Central Asian Flyway”.

7. Organic Farming in India

- India ranks first in number of organic farmers and ninth in terms of area under organic farming.

- Sikkim became the first State in the world to become fully organic.

- The major organic exports from India have been flax seeds, sesame, soybean, tea, medicinal plants, rice and pulses.

8. GM Crops in India

- India has the world’s fifth largest cultivated area under genetically modified (GM) crops, at 11.4 million hectares (mh) in 2017.

- The entire GM crop area is under a single crop-cotton, incorporating genes from the Bacillus Thuringiensis or BT soil bacterium coding for resistance against heliothis bollworm insect pests.

- The GEAC in 2007, recommended the commercial release of BT Brinjal, which was developed by Mahyco (Maharashtra Hybrid Seeds Company) in collaboration with the Dharwad University of Agricultural sciences and the Tamil Nadu Agricultural University. But the initiative was blocked in 2010.

- Dhara Mustard Hybrid-11 or DMH-11 is a genetically modified variety of mustard developed by the Delhi University’s Centre for Genetic Manipulation of Crop Plants. It was developed using “barnase / barstar” technology and is a herbicide tolerant crop. DMH-11 has not yet been approved for commercialization.

9. GM Crops Approval Mechanism in India

- The top biotech regulator in India is Genetic Engineering Appraisal Committee (GEAC). The committee functions as a statutory body under the Environment Protection Act 1986 of the Ministry of Environment & Forests (MoEF).

- Under the EPA 1986 “Rules for manufacture, use, import, export and storage of hazardous microorganisms/ genetically engineered organisms or cells 1989”, GEAC is responsible for granting permits to conduct experimental and large scale open field trials and also grant approval for commercial release of biotech crops.

- The Rules 1989 also define the competent authorities and composition of such authorities for handling various aspects of the rules.

10. PM-KUSUM

- The Ministry of New and Renewable Energy (MNRE) recently rolled out a massive solar-pump programme called the PM-KUSUM scheme.

- The Pradhan Mantri Kisan Urja Suraksha evam Utthaan Mahabhiyan (PM-KUSUM) scheme has a target to set up 25,750 megawatts (MW) solar capacity by 2022 to power irrigation pumps.

The approved scheme comprises of three components:

- setting up of 10,000 MW of decentralised ground / stilt-mounted grid-connected solar or other renewable energy based power plants

- installation of 17.5 lakh standalone solar agriculture pumps

- Solarisation of 10 lakh grid-connected solar agriculture pumps

11. RAISE 2020

RESPONSIBLE AI FOR SOCIAL EMPOWERMENT 2020

- RAISE 2020 is India’s first Artificial Intelligence summit to be organized by the Government in partnership with Industry & Academia.

- The summit would be a global meeting of minds to exchange ideas and charter a course to use AI for social empowerment, inclusion, and transformation in key areas like Healthcare, Agriculture, Education and Smart Mobility amongst other sectors.

- Organised by Ministry of Electronics & IT

12.e-Gram swaraj App

- The E-Gram Swaraj App is a step to make Gram Panchayats digital. This will provide Panchayats with a single interface to complete development projects and will provide information from planning of the project to its completion. This, in turn, will bring transparency and speed up the work of projects. The biggest advantage of this will be that every person in the village will know about the developmental project and the money spent on it.

13.Swamtiva Yojana

- This scheme has been launched for the purpose of measuring and documenting residential properties in rural areas. Under this scheme, the details of the properties falling under the boundary of each village will be collected with the help of drones. Later on, people will be provided with documents related to their property rights.

14. 15th Finance Commission

- 15th FC is to submit two reports – one for 2020- 21 and another for 2021-26.

- Article 280 of the Constitution of India provides for a Finance Commission as a quasi- judicial body, which is to be constituted every 5 years to recommend the distribution of net proceeds of taxes between Centre and states, and among states.

- It is constituted by the President of India every fifth year or at such earlier time as he considers necessary.

- The recommendations made by the Finance Commission are only advisory in nature and hence, not binding on the government.

Key recommendations

- Reduction in share of states in divisible pool of central taxes to 41% from prevailing 42%.

- Newly formed Union Territories of Jammu and Kashmir, and Ladakh, will now get funds from Centre’s share.

- Reintroduced performance-based incentives to states on 2 parameters – demographic performance (based on Total Fertility Rate) and taxation efforts.

- Rationalise centrally sponsored schemes and Centre and states should fully reveal their offbudget borrowings.

- An overarching fiscal framework for Centre & states, on lines of FRBM Act, to lay down accounting, budgeting and auditing standards to be followed at all levels of government.

- Enhanced devolution to local bodies compared to 14th FC.

15. National Statistical Office-NSO

- Government has decided to merge the Central Statistical Organisation (CSO) and the National Sample Survey Office (NSSO) to form a National Statistical Office (NSO), under the Ministry of Statistics and Program Implementation.

- Headed by a Director General, it is responsible for conduct of large-scale sample surveys in diverse fields on All India basis.

- Primarily data are collected through nationwide household surveys on various socioeconomic subjects, Annual Survey of Industries (ASI), etc.

- Besides these surveys, NSO collects data on rural and urban prices and plays a significant role in the improvement of crop statistics through supervision of the area enumeration and crop estimation surveys of the State agencies.

16. National Statistical Commission (NSC)

- The government released Draft National Statistical Commission (NSC) Bill which aims at empowering NSC to become nodal body for all core statistics in country.

- The NSC is the apex advisory body on statistical matters, but its suggestions are not binding on the government.

- It was set up in 2005 through a Notification on recommendations of Rangarajan Commission, as an interim measure. However, in the absence of any legislative framework, the NSC has faced challenges in implementing its recommendations

- Core statistics include national income statistics like GDP, jobs data, industry data and budgetary transactions data.

- Composition: a part-time Chairperson who is, or has been, an eminent statistician or social scientist, four part-time Members, Chief Executive Officer, NITI Aayog as ex-officio Member and Chief Statistician of India as its Secretary.

17. Basel Committee on Banking Supervision (BCBS)

- It is an international committee formed in 1974 to develop standards for banking regulation.

- It consists of central bankers from 27 countries and the European Union.

- It developed a series of policy recommendations known as Basel Accords, which suggested minimum capital requirements to keep bank solvent during the times

of financial stress. - Reserve Bank issues guidelines based on Basel III reforms for banks operating in India.

- The Basel III capital regulation has been implemented from April 1, 2013 in India in phases and it was to be fully implemented as on March 31, 2019.

18. Project Sashakt

- Project Sashakt was proposed by a panel led by PNB chairman Sunil Mehta.

- Bad loans of up to ₹ 50 crore will be managed at the bank level, with a deadline of 90 days.

- For bad loans of ₹ 50-500 crore, banks will enter an inter-creditor agreement, authorizing the lead bank to implement a resolution plan in 180 days, or refer the asset to NCLT.

- For loans above ₹ 500 crore, the panel recommended an independent AMC, supported by institutional funding through the AIF. The idea is to help consolidate stressed assets.

19. Reasons for a lag in monetary transmission in India

- Overdependence on banks– The Indian financial system remains bank-dominated, and the share of non-bank finance companies (NBFCs) and markets (corporate bonds, commercial paper, equity, etc.) is less. Hence, most public savings are in Bank deposits, reducing the banks’ dependency on repo rate.

- Locking of bank funds– due to double financial repression and priority sector lending.

- Increasing Non-Performing Assets– in bank balance sheets, which impedes the bank’s ability to offer lower interest rates.

- Sub-optimal performance of MCLR system– as suggested by the Janak Raj Committee.

20. Development Banks

- Development banks are financial institutions that provide long-term credit for capital-intensive investments spread over a long period and yielding low rates of return, such as urban infrastructure, mining and heavy industry, and irrigation systems.

- Such banks often lend at low and stable rates of interest to promote long-term investments with considerable social benefits.

- Development banks are also known as term-lending institutions or development finance institutions (DFIs).

- Development banks are different from commercial banks which mobilise short- to medium-term deposits and lend for similar maturities to avoid a maturity mismatch-a potential cause for a bank’s liquidity and solvency.

- Industrial Finance Corporation of India (IFCI) was the first development bank in India. It started in 1948 to provide finance to medium and large-scale industries in

India.

21. Digital Payment

- RBI has removed charges for payments via NEFT and RTGS and asked banks to pass on the benefits to customers.

- The merchant discount rate charges applicable on payment via RuPay and UPI have been removed.

- MDR is the cost paid by a merchant to a bank for accepting payment from their customers via digital means, which is usually recovered from the customer.

- RuPay and UPI are products of National Payments Corporation of India (NPCI).

- RuPay is the first domestic Debit and Credit Card payment network of India.

- UPI is an immediate real-time payment system to instantly transfer funds between multiple bank accounts through a mobile platform.This will give indigenously developed digital payment medium like RuPay and BHIM UPI an edge over the payment gateway promoted by foreign companies (eg.PhonePe, Google pay).

NPCI-National Payments Corporation of India

- NPCI is an umbrella organisation for operating retail payments and settlement systems in India, is an initiative of Reserve Bank of India (RBI) and Indian Banks’ Association (IBA) under the provisions of the

Payment and Settlement Systems Act, 2007.

22. National Strategy for Financial Inclusion

- Reserve Bank of India released National Strategy for Financial Inclusion (NSFI) for the period 2019-2024 to set forth the vision in expanding and sustaining the financial inclusion process at the national level through a broad convergence of action.

- NSFI has been organized and approved by the Financial Stability Development Council.

Recommendations

- Provide banking access to every village within a 5 km radius / hamlet of 500 households in hilly areas by March 2020.

- Strengthen eco-system for various modes of digital financial services in all the TierII to Tier VI centres to create the necessary infrastructure by March 2022.

- Enroll every willing and eligible adult enrolled under PM Jan Dhan Yojana under an insurance scheme (PMJJBY, PMSBY, etc.), Pension scheme (NPS, APY, etc.) by March 2020.

- Make Public Credit Registry (database of credit information of borrowers) fully operational by March 2022 so that organized financial entities could leverage it for assessing credit proposals from all citizens.

23. Financial Stability and Development Council

- It is apex level autonomous body constituted in 2010 to ensure financial stability, regulate the entire financial sector of the country and enhance coordination between various financial regulatory bodies.

- It is headed by the finance minister and heads of financial sector regulatory authorities are its member (RBI, SEBI, IRDA).

24.Consortium Lending

- Consortium lending is a process under which several banks finance a borrower based on common appraisal and documentation, and conduct joint supervision and follow-up exercises.

- Consortium lending has often led to inordinate delay in loan appraisal because of inability of banks to share data with each other in timely manner which delays funding for borrowers.

- It also resulted in adding more non-performing assets (NPAs) to the banking system.

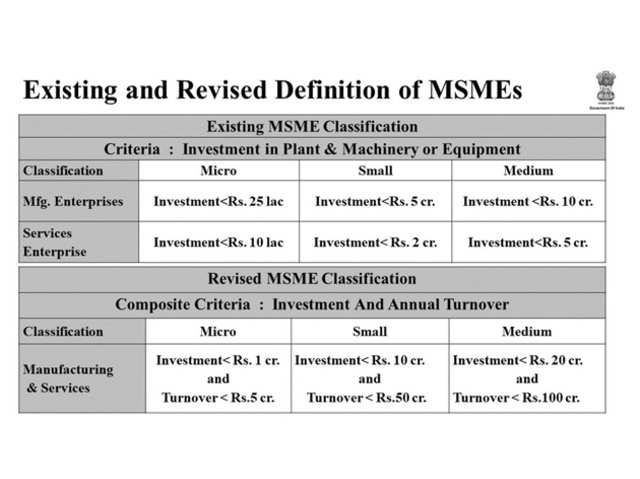

25. Revised Definition of MSMEs